Last Updated on October 11, 2023 by Calvyn Ee

Key Points

- July continues to see minor positive improvements in car sales and inventories

- The automotive industry seems to be heading down the right track, but the UAW strike and waning consumer spending may impact overall sales till the end of the year

- EV outlook still looks positive as Tesla continues to lead and other automakers struggle to keep pace

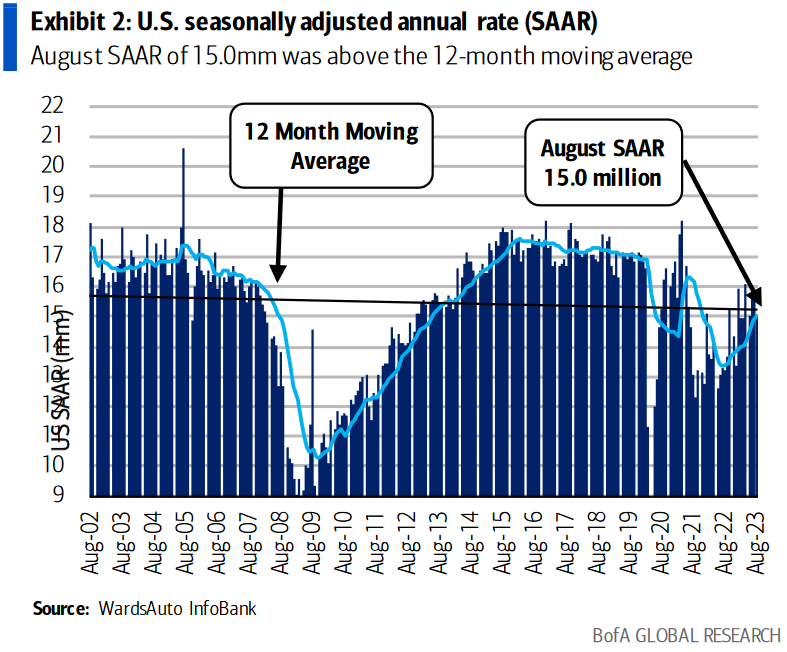

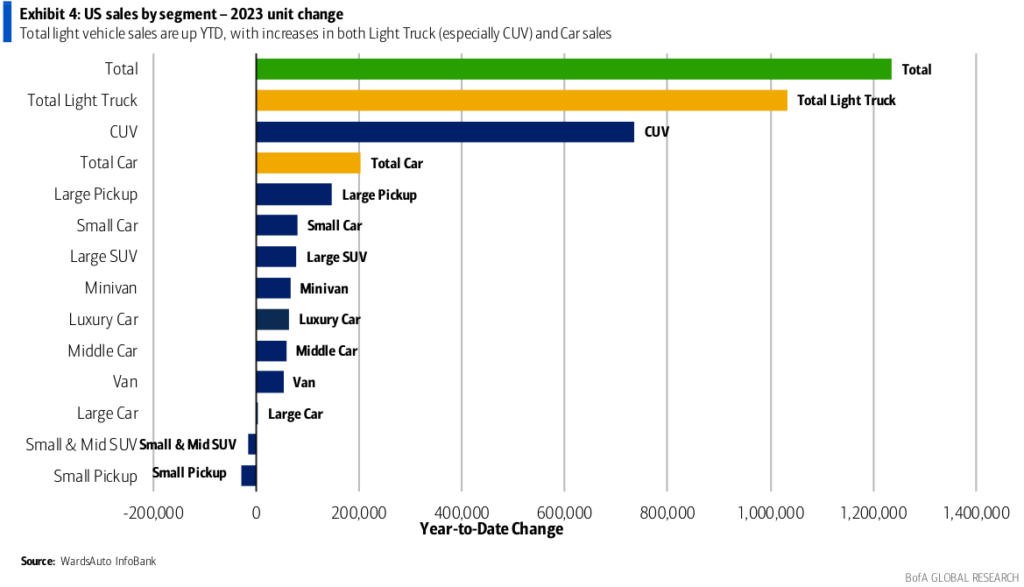

There’s yet another uptick in August as light vehicle sales went up by 13.6 percent year-over-year, following July’s prior increment. As a result, the seasonally adjusted annual rate (SAAR) reached 15.0mm, just below most estimates of 15.4mm. By volume, Cox Automotive suggests new vehicle sales had increased 2.2 percent from July to August.

Once again, strong fleet sales were instrumental in lifting auto sale performance, with Cox Automotive noting a 34 percent increase in sales of large fleets, which accounts for 172,075 units sold. With a market share of 15.6 percent, fleet sales are still outdoing retail sales. Sales to rental fleets won big with a whopping 102 percent increase. Meanwhile, sales into commercial fleets only went up by 1.2 percent.

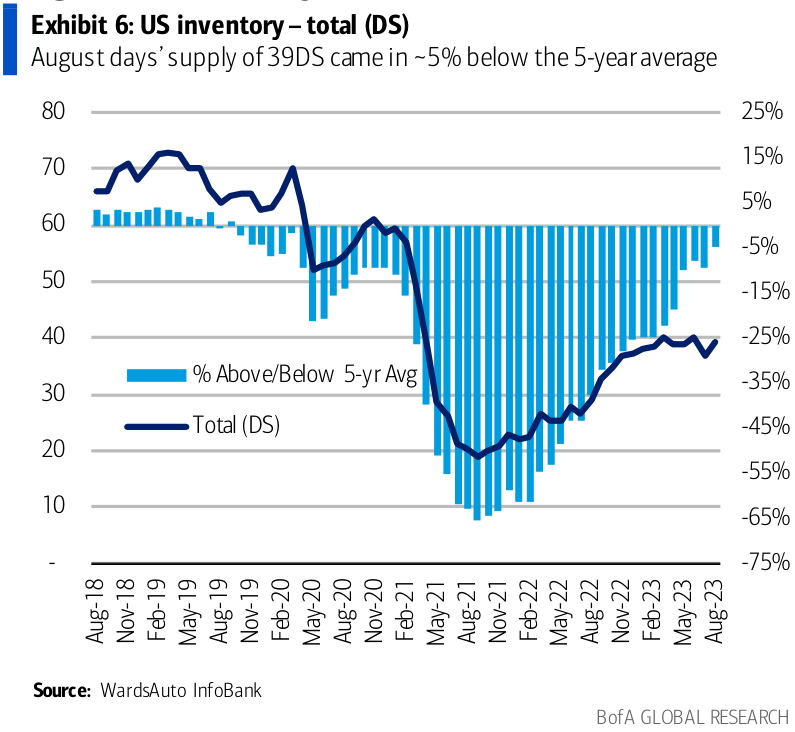

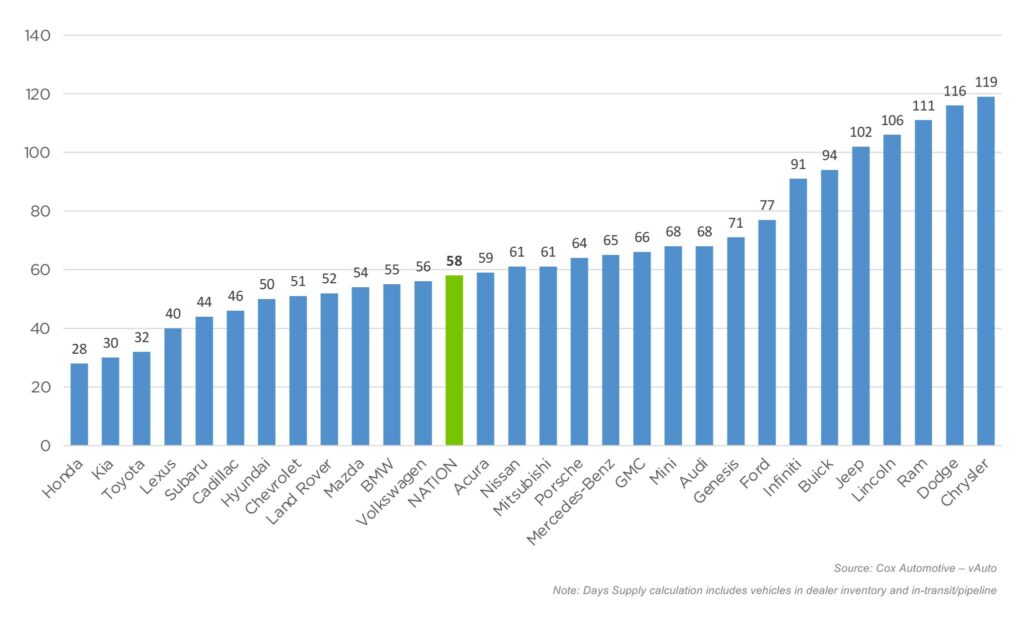

Total inventory increased by 140,000 units from the end of July, holding at 1.93 million units. Month-over-month, inventories continued to rise after a brief downward spell in July; almost half of this rise is attributed to the Detroit Three (Stellantis, GM, Ford) preparing ahead of a possible Union of Auto Workers (UAW) strike once the master agreement expires on the 14th this month (more on this later). Meanwhile, days’ supply (DS) is currently at 39DS, 2 days higher month-over-month but lower than the five-year average of 41DS.

In fact, most domestic brands currently hold “supply above the industry average” from the start of September. Only Cadillac and Chevrolet have far lower inventory levels at 46DS and 52DS, respectively. On the other hand, import brands still face lower inventory levels, particularly for Honda, Kia, and Toyota, which are all around or below 30DS.

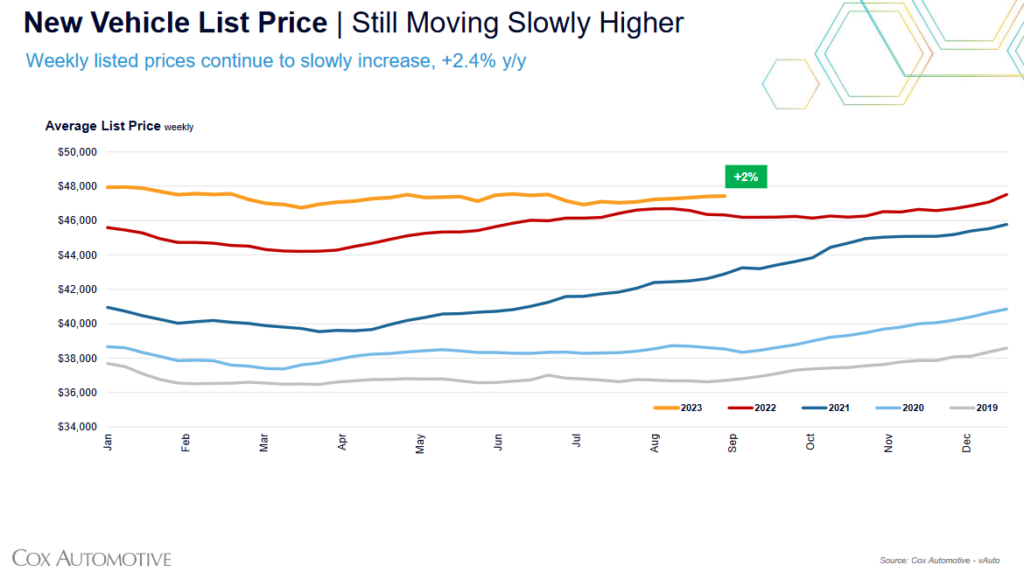

Average transaction prices (ATPs) for new vehicles have remained flat from the previous month. ATPs are $48,451 for August, which is 0.6 percent higher than July’s ATP and 0.1 percent higher than a year ago. Average listing prices have gone up to $47,417 at the start of September, marking a 2 percent increase “above year-ago levels.”

“Dealers and automakers are feeling price pressure, and with high auto loan rates and growing inventory levels, new-vehicle prices seem to have hit a ceiling, at least for now.”

Rebecca Rydzewski, research manager, Cox Automotive

As for incentives, the average incentive spending increased 10.3 percent to $2,365, an increment of 113 percent compared to a year ago. This would equate to 4.7 percent of the ATP, up from 2.3 percent last year. This is the highest it’s been since September 2021.

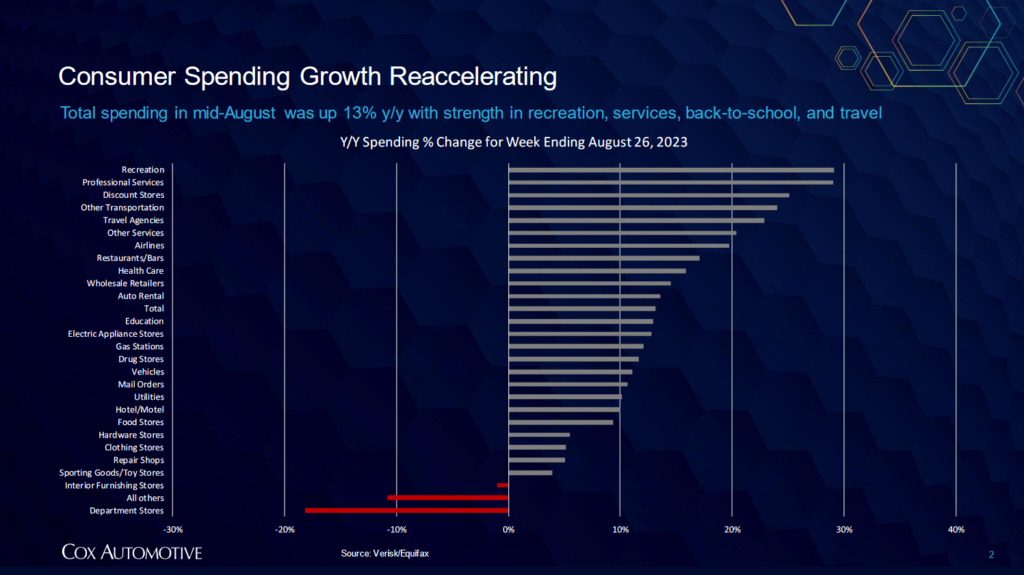

Promising Auto Performance

In a surprising turn of events, Cox Automotive noted that total consumer spending in early August went up by 16 percent year-over-year, with particular strength in travel, services, discount stores, and recreation. Much of this is driven by the back-to-school season. However, the modest uptick in vehicle sales in August reflects that consumers are still willing to spend their money on various things, including vehicles.

Much of this growth can be attributed to a few key factors:

- Home mortgage refinancings in the preceding years have helped provide “additional disposable income for many households”

- Higher incomes for many jobs, as well as increased wealth in some segments of society

- Smaller “new-to-used value proposition”

- Demand boom following the supply shortages during the pandemic years

Additionally, Cox Automotive reports that three vehicle segments held ATPs below $30,000 in August: compact cars, subcompact cars, and subcompact SUVs. Some choices include the Kia Rio, Nissan Versa, and Hyundai Venue, which hover between $20,000 and $25,000. The Mitsubishi Mirage, the only vehicle going for below 20k, is set to be discontinued soon; it’s the same story with the Rio.

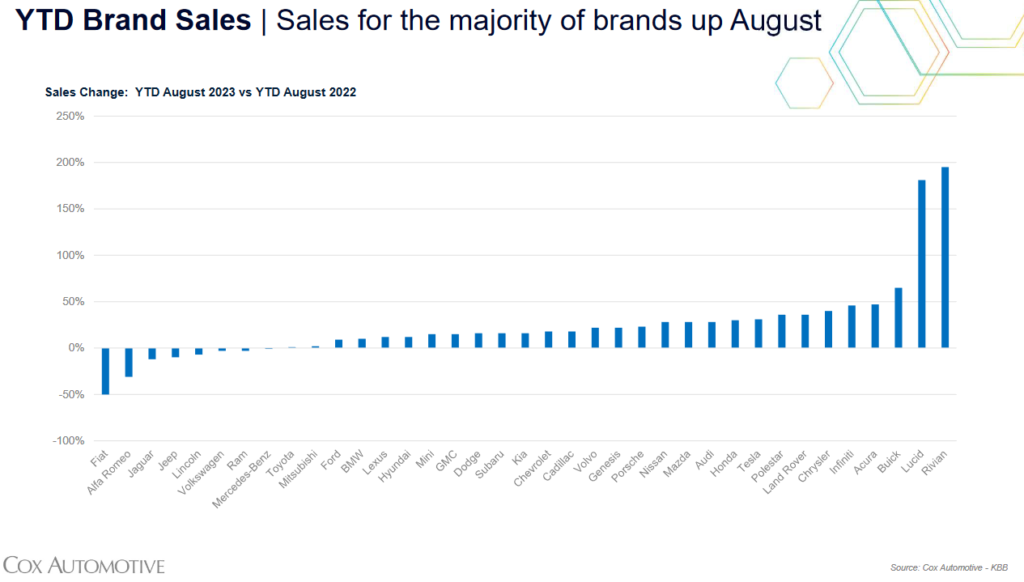

As you may have inferred from the inventory situation, sales have been a mixed bag across the industry. Honda recorded total monthly sales going up by 57 percent (56 percent for the Honda brand and 61 percent for the Acura brand) from last year, with equally promising year-to-date sales. Several luxury brands have also experienced positive “double-digit, year-over-year growth,” including Buick (65 percent), Acura (47 percent), and Infiniti (46 percent).

The luxury car market share stood at 18.8 percent despite the price increase from July to August. However, luxury car prices were still down 3.3 percent year-over-year at $64,107, with a 4 percent price decline since the year began. Much of it is attributed to Tesla’s surprising price cuts, as ATPs for various luxury brands, including Audi and Mercedes, have still seen year-over-year price increases as high as 10 percent.

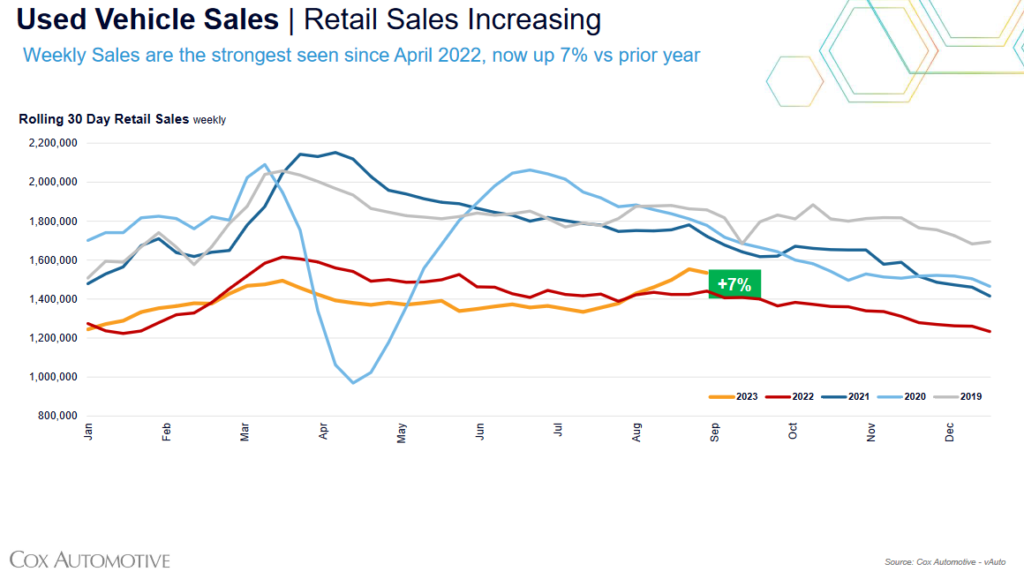

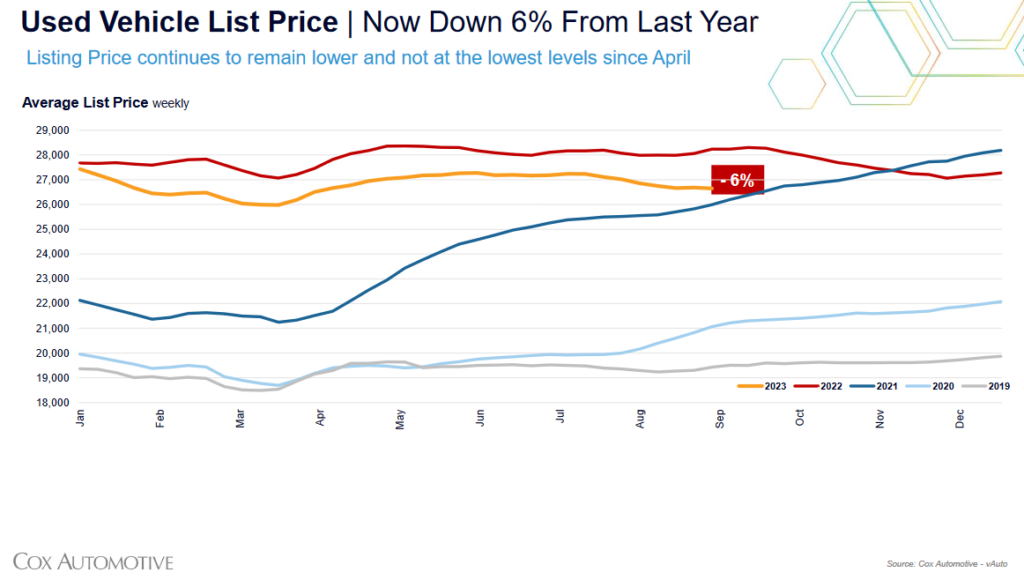

Used vehicles also see improving demand, with a much stronger sales pace than mid-July to late August 2019. The average used-vehicle listing price at the start of September was also at a promising $26,651. This is down 1 percent from last month (at $27,023) and 6 percent lower than August last year.

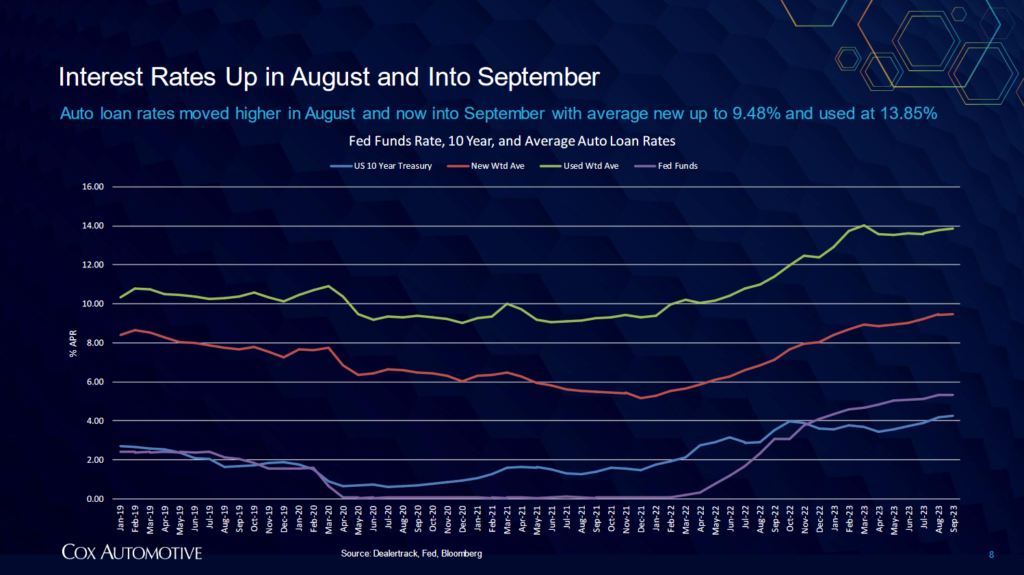

Further improvements to overall auto loan accessibility are also another important factor. Dealertrack’s All-Loans Index went up to 99.1 for the month of August, the highest it’s been since November last year; the higher score indicates “auto credit was easier to get than any time in 2023.” Good news, indeed, but auto loan interest rates remain high despite the positive signs on credit availability.

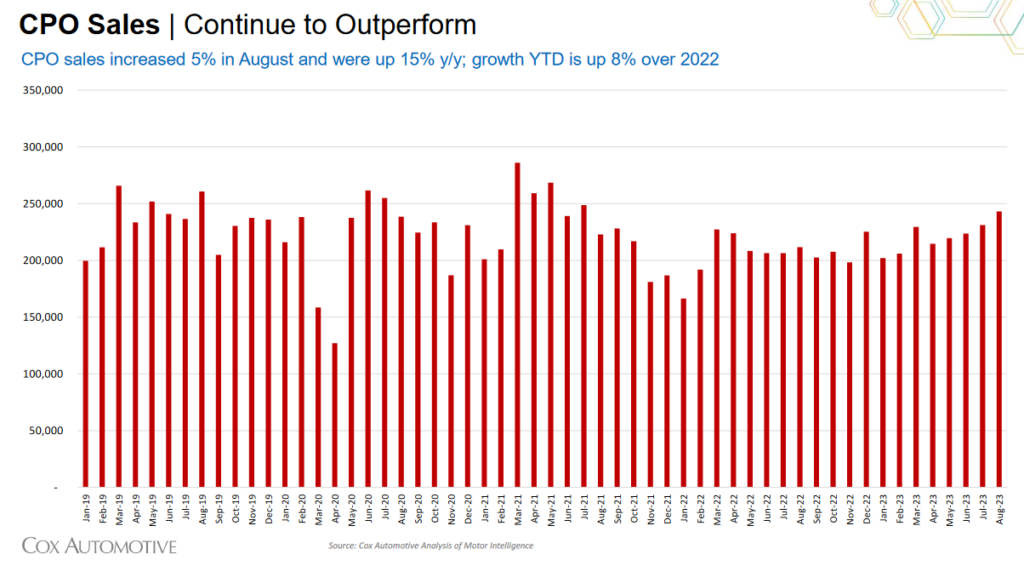

Additionally, certified pre-owned (CPO) sales saw a 5 percent increase in August, in part due to this credit loosening and how “some [CPO] programs are gaining traction” in lieu of the elevated vehicle price scenario of today.

While the outlook seems to be improving, dealers still hesitate to say that it is so.

Wherefore the Consumer?

For the most part, car buying is still happening as people are still willing to spend despite the high prices and interest rates. Used cars remain the more cost-effective option, given that their prices are nowhere as exorbitant as they were in the past months. But you can still find a good deal if you know where to look.

However, budget shoppers are left in the dust. While most cars, including used cars, are now more affordable than in early 2023, one can still cost at least 20k. This is even more pronounced with how auto loan rates are still elevated. Add to the fact that your only budget options for new cars are the Mitsubishi Mirage (which is severely underpowered) and the Kia Rio (which is only slightly better than the Mirage), and you can see why buyers are fuming.

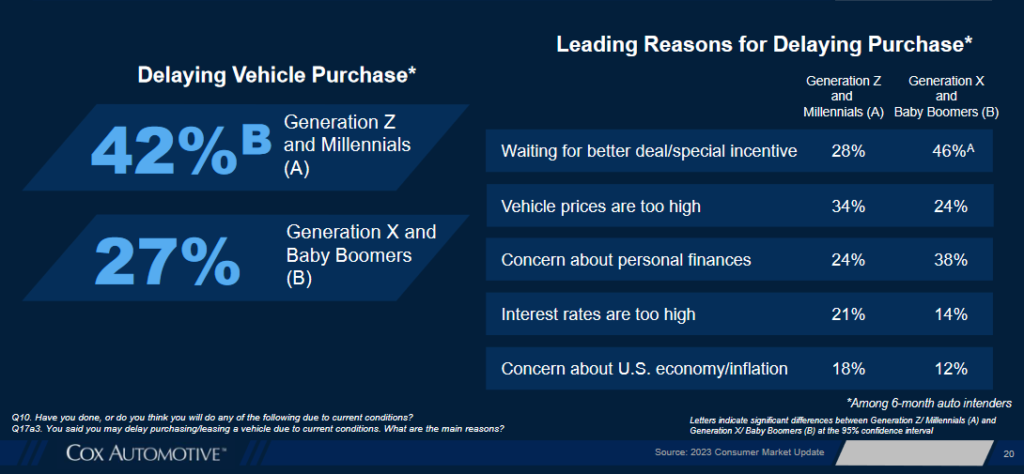

Additionally, consumer spending is still fluctuating. Some households may be flush with extra cash for buying cars, but not everyone has that luxury. Much like in the past, the spending strength in August doesn’t accurately indicate a more stable economy or better financial prospects. As a result, more shoppers would be willing to wait for prices to drop further and for better incentives to be offered.

The far lower numbers of low-interest (both 0% and <3%) financing plans also make it harder for some segments of the economy to reliably afford a car and keep up with the auto loan payments. The second quarter already recorded auto loan delinquencies at 7.3 percent, compared to the first quarter’s 6.9 percent. In fact, Moody’s has already warned that these delinquencies can potentially peak between 9 and 10 percent by 2024.

And that’s just auto loans. New credit card delinquencies (for those that are “30 or more days delinquent”) have already reached 7.2 percent in the second quarter, in contrast to the first quarter’s 6.5 percent.

This is reflected in Cox Automotive’s Dealer Sentiment Index (CADSI), which shows many dealers still view the “current auto market as weak,” though the sentiment does vary. Franchised dealers are more optimistic about the current market and its outlook than independent dealers. And while dealers are no longer worried about limited inventories holding their business back, they still worry about rising interest rates and future economic and market conditions.

The UAW Strikes Back?

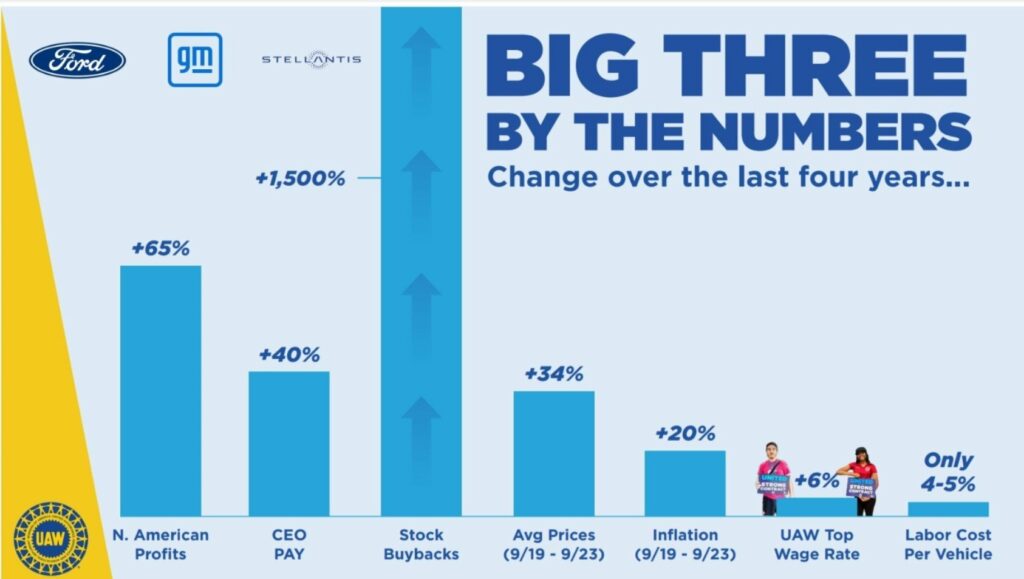

On that note, the deadline for new contracts between the Detroit Three and the United Auto Workers (UAW) union is set to begin. With both parties unable to reach an agreement, the planned simultaneous strikes are set to occur, leading to potential losses as high as $5 billion or more (for just 10 days of striking). UAW president Shawn Fain has already promised the strikes are “going to hit where we need to hit.”

That’s still provided the coordinated strikes, targeting specific auto plants, can successfully ground the Detroit Three’s auto production to a halt before their $825 million strike fund runs out. The UAW has struck down prior deals to the new contract’s terms despite calls for compromise from various external parties.

“The UAW’s demands include restoring defined benefit pensions for all workers, 32-hour work weeks and additional cost-of-living hikes, as well as job security guarantees and an end to use of temporary workers.”

Reuters

Some of the demands put forth by the UAW are considered “non-starters” owing to the significant long-term financial impact they can leave on the automakers. Assuming that the strike does successfully halt production and cause substantial losses for as long as they run their course, the Bank of America believes there could be potential bankruptcies waiting to happen among the Detroit Three, which will cause further harm as workers lose their jobs.

On the flip side, the UAW wishes to ensure that its members are adequately compensated for their time and effort, especially as the Big Three’s upper management saw substantial increases in compensation. Inflation may be coming down, but it’s still going at a snail’s pace; moreover, prices of goods and services aren’t going to return to normal levels anytime soon while households can’t keep up with the growing expenses.

Once the UAW goes on strike, it becomes a matter of how long they can last: if they go on for as long as the ongoing writer’s strike, which has no end in sight, the Big Three are going to feel the pinch as inventory dwindles, but they cannot reliably meet growing demand – hence the stocking-up of inventory in anticipation of a strike.

On the other hand, if the strikes don’t have the same longevity as the writer’s strike, then the overall impact will be minimal at best. Even so, other automakers aren’t really going to lose much in the event the strikes do happen. After all, the 146,000 UAW workers are all in the employ of the Big Three. Where the Detroit Three loses, their rivals stand to gain significantly.

Either way, we’ll have to wait and see how the strikes play out and how they’ll affect the auto industry as a whole.

What’s New with the EV Outlook?

In the meantime, EVs continue to see further declines in prices thanks to Tesla’s price cuts and incentives for the average consumer (such as tax credits), with the average price paid for an EV standing at $53,376 – a modest decline from July’s $53,633 figure. Meanwhile, EV incentives were 8.1 percent ($4,298) of ATPs in August.

As it stands, August has seen EV manufacturers like Lucid, Rivian, and Polestar doing rather well for themselves. Lucid and Rivian, in particular, saw sales more than double between last year and this year. Of the two, Rivian saw the highest gains, with sales up 195 percent, or 29,532 units; Lucid gained 181 percent, accounting for 3,890 units sold. Meanwhile, Polestar saw sales increase by 36 percent.

Tesla continues to dominate the EV market, with over 390,377 new registrations in the first seven months of 2023. This effectively places their market share at 59.5 percent of the US EV market. Chevrolet comes in second with a 6 percent market share, while Ford is third with a 5.2 percent market share.

Given current elevated prices, this still doesn’t mean that more car shoppers would be incentivized to buy an EV. Dealers are particularly pessimistic about the outlook of EV sales through the rest of the year, though that may partly be due to “over-supply rather than a lack of demand,” as Cox Automotive’s Jonathan Smoke states. In fact, he’s optimistic that things will change for the better as EV competition ramps up.

“…I can pretty confidently predict that surplus inventory and increased competition will eventually drive down prices, which will help with EV consideration and adoption.”

Jonathan Smoke, Chief Economist, Cox Automotive