The automotive world is in the fast lane of transformation. SUVs and trucks are dominating driveways, EVs are steadily charging into the spotlight, and hybrids are quietly stealing the show. Meanwhile, sedans are finding themselves parked on the sidelines, wondering where the party went.

Amid this evolution, manufacturers are juggling traditional production, emerging technologies, and fierce competition to stay ahead in a dynamic and ever-changing landscape. Let’s dive in this month’s economic watch to find out what’s the deal in the automotive world.

KEYPOINTS

- Global light vehicle sales are bouncing back, with SUVs and light trucks dominating over 80% of the market, leaving sedans and compact cars struggling to keep up.

- Electric vehicles and hybrids are steadily gaining traction, driven by consumer demand for sustainability, technological advancements, and incentives like BEV tax credits, although gas-powered cars still hold a significant share.

- Legacy automakers like Ford, GM, and Toyota are thriving by balancing EV innovation with traditional production, while startups like Rivian and Lucid face scaling challenges in a fiercely competitive market.

- Deals are available, but scoring a bargain requires a bit more effort, and rising interest rates could start to chip away at affordability.

Of Sales and Inventory

The U.S. auto market surpassed expectations in November, with a Seasonally Adjusted Annual Rate (SAAR) of 16.7 million units, leaving the forecasted 16.1 million units in the dust with a brisk 10.2% year-over-year (YoY) growth.

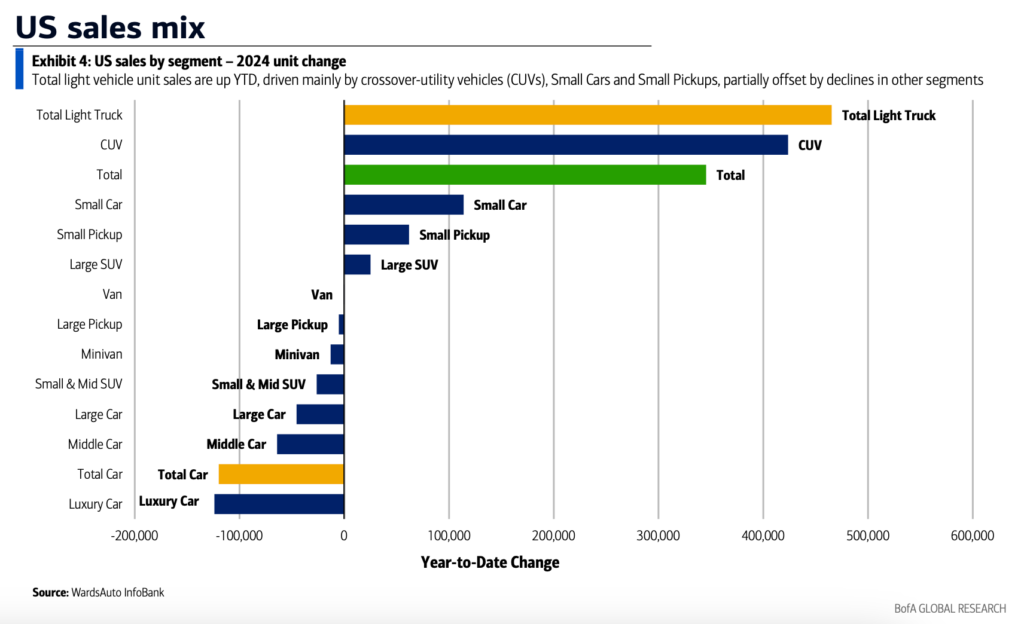

Globally, light vehicle sales are rebounding, projected to hit 82.7 million units in 2024, a solid rebound, even if we’re not quite at pre-pandemic speeds yet. Passenger cars continue to lose ground, making up less than 20% of sales, while light trucks, including SUVs and pickups, dominate with over 80% of the market share.

Average transaction prices (ATP) for new vehicles remain elevated, largely fueled by strong demand for higher-trim SUVs and trucks. Speaking of SUVs and light trucks, these big, versatile crowd-pleasers are flying off the lots, thanks to high demand and smoother production pipelines.

On the flip side, sedans and compact cars seem to be going the way of that treadmill in your garage—just sitting there, unused, while everyone’s focused on something more exciting. It’s no mystery why—these utility-packed, tech-savvy rides are the Swiss Army knives of the automotive world, beloved by families and weekend warriors alike.

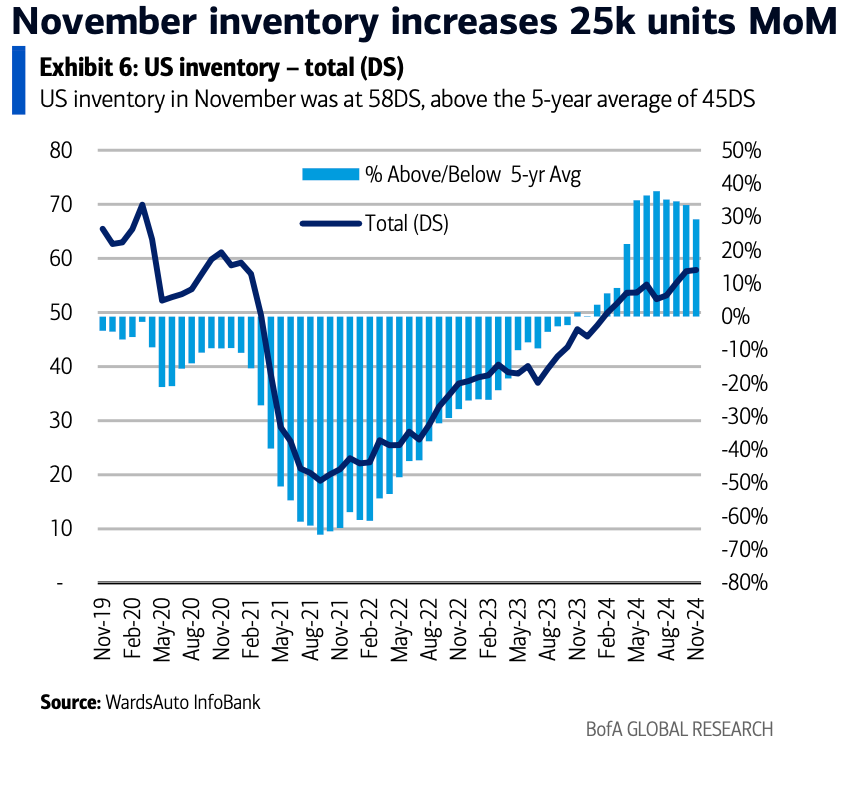

As we talk about stocks and inventory, the auto industry is finally getting its groove back as inventory levels settle into pre-pandemic norms. With 58 days of supply on hand (up from a tight 47 days last year), car shopping is starting to feel less like a scavenger hunt. Automakers like Ford (96 days) and GM (70 days) are sitting pretty with ample stock, while Stellantis is hurrying to catch up. For buyers, this means less waiting and more chances to drive off in their dream SUV or truck without breaking a sweat.

The market’s bounce-back is also a testament to smoother supply chains and consumer confidence revving back up. With India and North America leading the charge thanks to their love of bigger, bolder vehicles, the stage is set for growth. Throw in some juicy manufacturer discounts and a last-minute scramble to cash in before 2025 tax credit changes, and you’ve got a market that’s not just recovering—it’s hitting the accelerator.

?For dealers, this is an opportunity to get creative. Flexible pricing and juicy promotions could help clear out the slower-moving inventory while capitalizing on the booming interest in SUVs and trucks. It’s also a chance for them to ditch the “sold out” signs of the past and make the car-buying process fun again. The big takeaway? The market is stabilizing, and that’s great news for everyone. Just don’t be surprised if large sedans keep gathering dust—they might need a new marketing trick or two to get back in the game. For now, SUVs and trucks are ruling the road, and the rest are just along for the ride. Dealers face their own challenge of keeping up with high-demand models while sedans and compact cars face an oversupply issue that manufacturers must address to avoid them becoming dead weight. Stability might be here, but staying agile and responsive to changing market demands is the real key to keeping the momentum going.

The Road Ahead Looks Charged (and Slightly Hybrid)

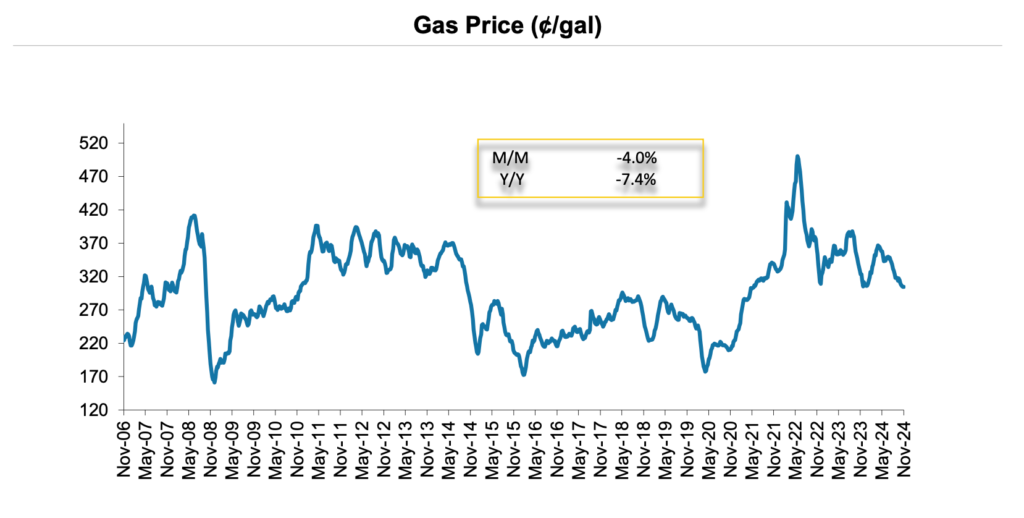

Stable gasoline prices are providing drivers some relief, easing cost pressures at the pump and keeping gas-powered vehicles relevant—for now. Meanwhile, raw material costs for steel and aluminum are stabilizing, helping automakers manage profitability even as they introduce incentives and invest in EVs and hybrids. This balance allows manufacturers to maintain margins while preparing for a more sustainable future.

However, this reprieve may be temporary. While stable fuel prices benefit gas-powered vehicles in the short term, the industry’s focus is clearly shifting toward hybrids and EVs, which promise long-term savings and sustainability. Rising auto loan balances highlight the growing need for creative financing solutions, such as affordable loans or leasing options, to keep vehicles accessible to a wider audience. The question isn’t if the transition to EVs will happen, but how smoothly the industry can navigate these changing dynamics.

EVs are steadily making inroads, now accounting for 8.8% of total sales in November, up from 6.8% last year. Tesla’s dominance is waning, with its market share dropping from 51.9% to 42.7%, as legacy automakers like Ford and GM strengthen their presence. Ford’s EV share rose to 9%, and GM’s to 13%, demonstrating their ability to compete in the EV space while leveraging their manufacturing expertise. The rush to secure BEV tax credits before changes take effect in 2025 has also added momentum to EV sales.

Still, EVs remain a smaller part of the market compared to gas-powered vehicles. Non-Tesla EV sales are up 40% YoY, but startups like Rivian and Lucid are struggling with scaling production and high costs. The future of EVs depends on advancements in battery technology, expanded charging infrastructure, and affordability.

Hybrids, meanwhile, are experiencing significant growth, with sales increasing 40.4% YoY. They offer a practical middle ground for buyers hesitant to go fully electric, alleviating concerns about range and charging availability. For many, hybrids provide the convenience and reliability of gas-powered cars with added efficiency, keeping them a popular choice as the market transitions toward electrification.

? The urgency for EV adoption might be on a halt due to stable prices, particularly in regions where fuel efficiency isn’t a major concern. Lower fuel costs make gas-powered vehicles more appealing in the short term, while stabilizing raw material prices enable manufacturers to maintain profitability as they invest in new technologies and offer incentives. This moment of stability allows automakers to strategically balance current production with future-focused innovation, especially in the hybrid and EV segments, which are poised for long-term growth. However, this stability won’t last forever. The shift toward hybrids and EVs is inevitable, driven by environmental goals and changing consumer preferences. Rising auto loan balances also underscore the need for flexible financing and leasing options to maintain affordability amid economic fluctuations. Automakers should seize this period to strengthen their EV offerings and build infrastructure, ensuring a smoother transition to a greener, more sustainable future while keeping vehicles accessible to a broader audience.

Manufacturer and Stock Insights

Right now, we can see a healthy balance of competition in the automotive market, with domestic automakers like GM, Ford and Stellantis holding 40.7% of the market and Asian brands like Toyota, Honda, and Hyundai or Kia leading at 47.7%. European luxury brands like Mercedes-Benz and BMW round out the mix with 11.5%, catering to a premium niche. Legacy automakers like Ford, GM, and Toyota are thriving thanks to their ability to juggle gas-powered production while transitioning effectively into the EV space—a skill that startups like Rivian and Lucid are struggling to match.

For startups, the road ahead is steep. High production costs, scaling challenges, and limited brand trust make it difficult to compete with well-established players. However, their innovation and ambition keep them in the game, even if it’s a tough one. Meanwhile, consumers are reaping the rewards of this increased competition, as it puts pressure on automakers to improve EV pricing and features. Asian automakers, in particular, are making strides by offering competitive pricing and appealing designs, while European brands hold their ground with luxury-focused models.

Ultimately, the market’s diversity is a win for buyers, as the race to balance affordability, innovation, and brand value intensifies. Whether you’re team legacy or rooting for the underdog startups, the competition is driving the industry toward a more dynamic and consumer-focused future.

? Startups like Rivian and Lucid, though ambitious, face significant challenges in scaling production and building trust. Their uphill battle highlights the value of established infrastructure and brand equity, which legacy automakers are leveraging to great effect. For consumers, the upside of this competition is clear: better pricing, improved features, and a greater variety of vehicles to choose from, whether they’re looking for gas-powered reliability, hybrid efficiency, or cutting-edge EV technology. The road ahead will demand constant innovation and adaptability from all players. Established brands must stay agile to fend off rising competitors, while startups need to prove they can deliver at scale. In this race, the real winners are the buyers, as the industry accelerates toward a future where quality, choice, and affordability align more closely than ever before.

What’s Next?

The automotive industry stands at a pivotal crossroads, navigating a landscape defined by recovery, innovation, and changing consumer demands. As inventory levels stabilize, consumers will enjoy greater access to popular models, albeit at higher price points, particularly for premium trims and EVs. For buyers, the current market presents opportunities to maximize value through trade-ins and financing options, while dealers and manufacturers must seize this moment to fine-tune pricing strategies and promote eco-friendly models like EVs and hybrids.

For automakers, the future will hinge on balancing traditional vehicle production with the rapidly expanding EV market. Success lies in not just meeting regulatory demands for sustainability but also delivering advanced features that resonate with modern consumers. Investment in AI, automation, and lightweight materials will define the next wave of manufacturing innovation, enabling companies to stay competitive. Emerging markets in India and Southeast Asia present untapped potential, promising growth opportunities for forward-thinking brands.

The road ahead is dynamic, and the industry’s ability to adapt to economic fluctuations, technological advancements, and consumer shifts will determine its long-term resilience. Whether it’s established giants transitioning to EVs, startups vying for trust, or dealers reimagining their strategies, the automotive world is on the brink of transformative change. Those who steer wisely will not only navigate these challenges but also thrive in the future of mobility.