Last Updated on July 23, 2021 by Jason Mason

Why you should run for the hills when a company offers an extended warranty

You just bought your new car. Whether it’s new off the assembly line or new to you, it doesn’t matter. You sign the contract and then get whisked away into some office. You’re talking with someone new that’s pushing all kinds of packages on you. The biggest one they’re trying to promote? The extended warranty.

You’re a little stressed because you just dropped a ton of money on a car, and now someone’s offering a way to protect that investment. Sounds like a no brainer, right? Wrong.

The reason is simple; extended warranties make the dealerships a ton of money. How? Because it’s a scam that’s going to be a huge moneymaker for the dealership. Don’t believe us? Keep reading.

What do Extended Warranties Cover?

Not as much as you think. It’s true that each extended warranty is different. And it’s exactly what every dealership or private warranty company is going to sell to you during their pitch. And they’re not wrong. That’s why it’s essential to know the terms of the trade BEFORE you start speaking to a salesperson.

What exactly is a powertrain warranty? What voids my warranty? Where do I have to complete my scheduled maintenance? These are all things that you need to know to avoid getting ripped off.

And the more you know, the more you’ll start to realize the extended warranties just aren’t worth it.

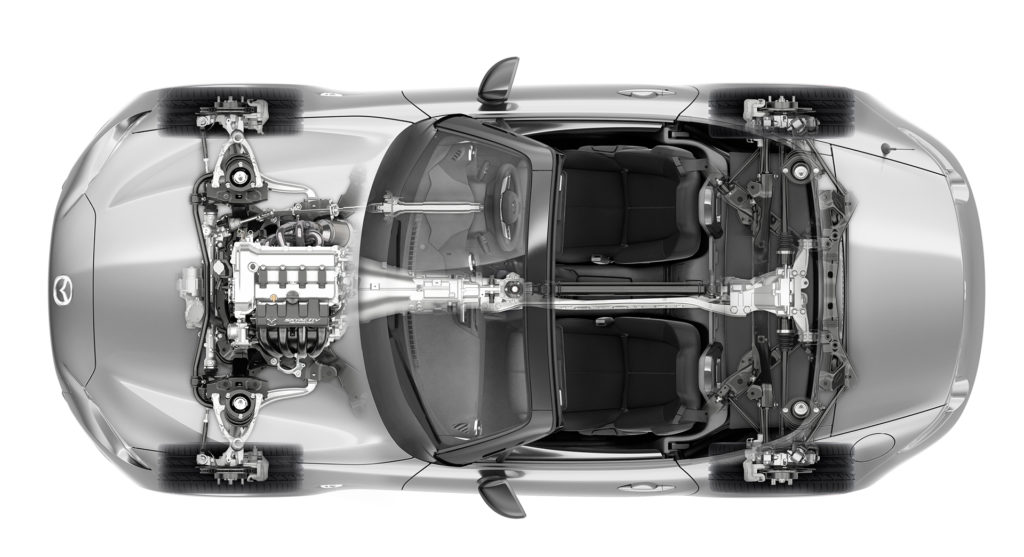

The Powertrain Warranty

It’s the ultra-basic warranty. Of course, it’s not going to be sold to you that way. The line will go something like this “it covers the most expensive components of your car.” And it’s true. A powertrain warranty will cover your engine and transmission.

But what the salesman isn’t telling you is that those are the least likely parts to break over the course of the extended warranty. And it doesn’t cover everything on the engine or transmission. Sparkplugs, filters, belts, alternators, and more probably aren’t covered. And it’s because most warranties define these things as wearable parts. And wearable parts aren’t covered.

Comprehensive Warranties

When it comes to warranties, comprehensive warranties are what you want. But you’ll still need to read the fine print. That’s because every comprehensive warranty is different. Some will cover everything, and some will only cover your powertrain, steering, and suspension.

They’re better than powertrain warranties, but even the most comprehensive extended warranties won’t cover everything. You’ll still be on the hook for routine maintenance like your oil changes, brakes, and sparkplugs.

Voiding your warranty – it’s easier than you think

Miss an oil change, complete your oil change at the wrong dealership, or replace a part with something aftermarket – even if it’s a better part, and you could void your warranty. Often, it’s part of the scam. Dealerships will make you get all of your maintenance done there, and if you don’t, you void your warranty.

They charge you for the warranty, then charge you, even more, every time you need an oil change. Even worse, they often tell you that you need things that you don’t when you bring your car in. And if you don’t get the work done, the warranty you already paid for is voided.

And the aftermarket warranty companies aren’t any better. They often won’t tell you what kind of maintenance records you need to keep, acceptable repair shops to complete your oil changes, and what kind of parts you need to use.

When something goes wrong, they can try to weasel their way out of the warranty—anything they can do to avoid paying out.

Do You Really Need that Warranty?

It doesn’t matter who you ask; today’s cars are more reliable than ever. With every year, the mechanics get better, and you’re less likely to need to take your vehicle into the shop. But while the cars have been improving, the prices of the extended warranties have stayed the same.

The average repair cost when something on your car breaks is just under 200 dollars. Meanwhile, the average price of an extended warranty is 2,000 dollars. Simple math tells you that you’ll need 20 different things to break just to break even on your extended warranty.

Unless your engine or transmission goes up, which is extremely unlikely, or your car breaks every other month, you’re going to spend too much on the warranty.

Of course, part of the pitch for the warranty is that you don’t have to pay for it up front, they’ll roll it into your loan. But then you end up spending even more on your warranty.

How Much Does Your Warranty Really Cost?

The average cost for an extended warranty is about 2,000 dollars. But when it’s rolled into your loan, it ends up costing even more because of interest.

For example, a 48-month used car loan for 15,000 dollars with a 9.5% interest rate costs about 377 dollars a month. When you add in a 2,000-dollar warranty, your monthly payments are now 427 dollars a month. At 50 dollars a month for 48 months, you spent 2,400 dollars for your extended warranty.

Even if you’re getting a better interest rate, you’re still paying more for your warranty when you roll it into your loan.

But that’s not where the costs stop. Because you have to take the car to the dealership to get your routine maintenance completed, you’ll end up spending more money there too. So that 30,000-mile extended warranty that you bought? You have to pay an extra 300 dollars just for oil changes.

When you add in sparkplugs, air filters, and everything else you need to maintain your car properly, you might be spending over 3,000 dollars for your warranty. That’s about the same cost as 15 repair shop visits!

So, what’s the better option? Taking the extra money, you’d be dropping towards your extended warranty, and putting it back in case something pops up. You’ll get your peace of mind and keep your money.

Why Every Dealership Pushes Extended Warranties

Without fail after you buy a car, the dealership will try to push the extended warranty onto you. And the reason is simple; it’s a huge moneymaker.

Most of the time, you won’t need your extended warranty at all, and if you do, the repairs almost never add up to the cost of the warranty. Even better for the dealership, most of their warranties mandate that all of your repairs are done at their dealership.

That means they get even more money whenever your car needs an oil change or any other kind of routine maintenance. Show up late for an oil change, and they void your warranty. Fail to get any of the “recommended” repairs, and they void your warranty.

Even worse, dealerships are notorious for recommending repairs that don’t need to be completed. That means you’ll be on the hook for getting unnecessary repairs done, adding to the cost of your warranty.

But if you do end up voiding your warranty, don’t count on getting that money back. Once you’ve paid for the extended warranty, you’re often stuck with it, even if you void it or try to cancel it.

Dealerships love extended warranties; customers shouldn’t.

Manufacturer Extended Warranties vs. Third Party Warranties

When it comes to warranties, there are two different kinds. Manufacturer extended warranties and third-party warranties. It’s essential to know the difference before you get swindled into something that you don’t want.

Manufacturer Extended Warranties

These warranties are often sold by the dealerships and carry the backing of the vehicle’s manufacturer. This means that every dealership for that car manufacturer should honor the warranty. This is exceptionally beneficial because most auto manufacturers have dealerships all over the country.

This gives you options when you go to use your warranty or when you’re getting your routine maintenance completed.

However, this does not mean that you get to pick your repair shop if something goes wrong, and it doesn’t mean that you can complete your routine maintenance anywhere. You’re still stuck at the dealership, which typically charges more than other places for things like oil changes and other repairs and maintenance.

Third Party Warranties

Unlike manufacturer extended warranties, third party warranties don’t carry the backing of the vehicle’s manufacturer. They still might be sold by the dealership, or they might be sold by an independent repair shop or an exclusive warranty service.

They offer a ton of options, and they all have their own stipulations. Some will require specific repair shops, and others will only cover specific components. Complicating the matter further, there is often a complicated claims process to use your warranty, and you might have to pay the expenses upfront and hope that they reimburse you the full amount.

That’s because third party warranties often have set rates that they cover for repairs, so you’ll be stuck with taking it to a cut-rate shop or paying out of pocket.

Better Options than Extended Warranties

You want that peace of mind that comes with an extended warranty, but you don’t want to get ripped off. It makes sense. The best option is to research the car’s history and reliability ratings. There are a variety of services that offer this from consumerreports.org to Edmunds.

Getting a reliable car gives you a decent amount of peace of mind. To get the rest of the way there, you can put the money back that you would be putting into buying the extended warranty.

Considering the average cost of an extended warranty is 2,000 dollars, and the average repair cost is under 200, you’ll have a pretty large safety net built up. Even if you don’t have the 2,000 dollars upfront, you can take the extra money that would be tacked onto your loan and put it into a car repair fund.

If it were an extra 50 dollars a month, you’d have enough money to cover the cost of most repairs in only four months. And if your car isn’t going to last four months off the lot, then you should be looking for a different car anyways!

Picking the Right Car

The best way to save money and ensure that you won’t need an extended warranty? Get a car that’s going to last. It’s a little more work upfront, but you don’t want a vehicle that’s going to break down on you, even if you buy the extended warranty and get lucky enough to have it honored.

You can look up the history of a used car through CARFAX. It’ll give you a complete breakdown of the vehicle’s history, including maintenance records, accident history, and the number of owners. From there, you should go to either Consumerreports.org or Edmonds and pull up reliability ratings for the car you are purchasing.

For used cars, this is easy, just put in the make and model, and they’ll break down how reliable every component on the vehicle is and any potential problem areas. It’s a quick and easy way to see if you might be purchasing a lemon.

The best thing to do if you’re getting ready to buy a new car is to look up the reliability ratings of the same make and model car, just a few years older. You don’t want to go too far back, but 3-5 years should give you a decent idea of whether or not those cars have been reliable in the past.

If the answer is that the car isn’t going to be reliable, buy a different vehicle, not the extended warranty!

Conclusion

When it comes to getting the most bang for your buck, skip the extended warranty. Instead, do your homework and get a car that’s going to last. Of course, you should always have some money set aside for an emergency fund. Even if you don’t yet, use the money you’d be wasting on an extended warranty to set one up.

You’ll get the same peace of mind that comes with an extended warranty without throwing your money down the drain!